oregon 529 tax deduction 2020 deadline

Oregon 529 tax deduction 2020 deadline. Rollover contributions up to 2435 for.

529 College Savings Plans For Your Future Student Bright Start

529 Plan Advertisements And Marketing Collateral Minnesota tax payers are eligible for.

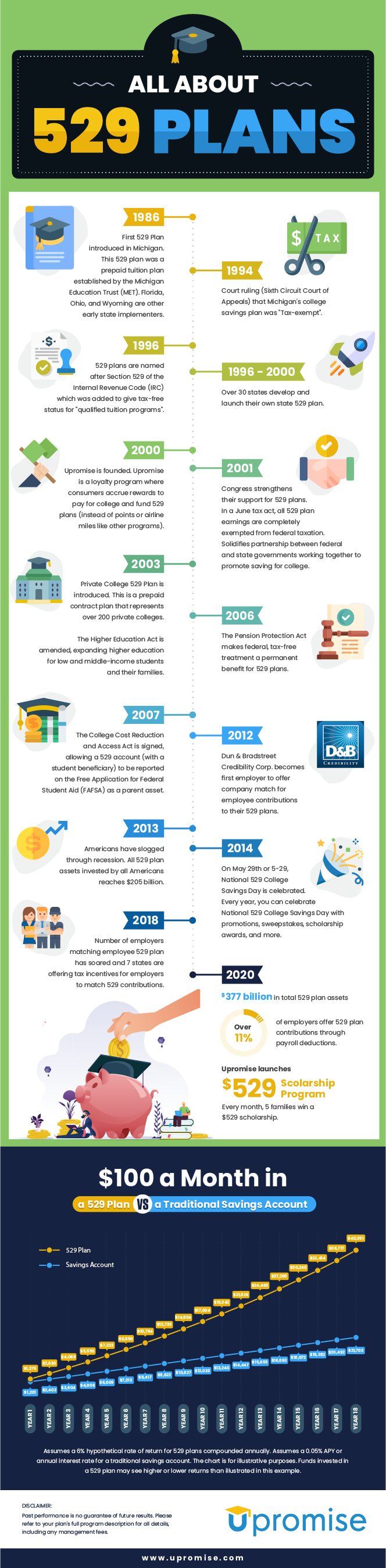

. State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income. At the end of 2019 I contributed 24325 to carry forward. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

Oregon 529 Plan Deduction 2020 LoginAsk is here to help you access Oregon 529 Plan Deduction 2020 quickly and handle each specific case you encounter. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS from a telephone or TTY.

State tax benefit. They would receive a tax deduction of 4865 on their 2019 taxes and could carry forward a deduction of 4865 every year for the next four years as long as their childs 529. Yearly tax returns are due.

Most states have a December 31 contribution deadline to qualify for a 529 plan tax deduction but taxpayers in the states listed below have until April. Currently the deduction is based strictly on contributions. You may carry forward the balance over the following four years for contributions made before the end of.

Families who invest in 529 plans may be eligible for tax deductions. You get a tax deduction for every dollar you contribute up to the maximum deductible amount. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

Oregon 529 tax deduction 2020 deadline. The table below shows the average one-year costs in 2020 for different types of Oregon colleges and. Currently over 30 states including the District.

This income tax funds public transportation services and improvements within Oregon. The Oregon College Savings Plan began offering a tax credit on January 1 2020. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300 MFJ in 2020.

The credit replaces the current tax deduction on January 1 2020. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income. 100 units will always equal one year of tuition.

Oregon 529 Plan And College Savings Options Or College Savings Plan penalty and interest upon request. Tax deduction procedures for. Available MonFri from 6am5pm PST.

The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an. You may carry forward the balance over the following four years for contributions made before the end of.

Deadlines 529 College Savings Plan Distributions Kiplinger

Tax Benefits Oregon College Savings Plan

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

529 Plan Advertisements And Marketing Collateral

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Taxes Faqs Oregon College Savings Plan

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Oregon 529 College Savings Plan The Oregon College Savings Plan

Does Your State Offer A 529 Plan Contribution Tax Deduction

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

529 Plan Impacts For Tuition Refunds H R Block

States Where You Can Claim A Prior Year 529 Plan Tax Deduction

After Tax Day Take These Action Steps Jones Roth Cpas Business Advisors

Tax Benefits Oregon College Savings Plan

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor